44+ is second home mortgage interest deductible

Web For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or. Web Answer Yes and maybe.

We Want To Buy A Second Home Can We Deduct The Mortgage Interest

Check out Pre-qualified Rates for a 2nd Mortgage Loan.

. The rate on a 30-year fixed refinance decreased today. Home values have risen dramatically in recent years although some of those gains may have been lost over the last 12 months due to. Web So if you have one mortgage for 500000 on your main residence and another mortgage for 400000 on your vacation home you cant deduct the interest.

Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000. Reviews Trusted by 45000000. Web 6 hours agoApply when values are high.

Single or married filing separately 12550. Apply Directly to Multiple Lenders. Pub 936 says if all mortgages fall in one or more of the above.

Homeowners who bought houses before. The average rate for refinancing a 30-year fixed mortgage is currently 705 according to Bankrate. Ad Get Your Home Loan Quote With Americas 1 Online Lender.

Web For 2021 tax returns the government has raised the standard deduction to. Married filing jointly or qualifying widow. 2 before Dec 16 2017 and under 1M.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Compare Home Financing Options Online Get Quotes. Web To be deductible your second mortgage must be secured by your home.

Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan. If its not used as collateral it doesnt qualify for the home mortgage interest deduction.

Web 1 before 1987. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. Find Your Best Offers.

Web If those same 4 interest rates applied then youd only be able to deduct 40000 instead of the 80000 you presumably paid in interest that year. Web Generally for the first and second categories you can deduct mortgage interest on up to 1 million 500000 for those married filing separately. 3 after Dec 16 2017 and under 750k.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web 10 hours agoGetty.

Compare 2023s Top Second Mortgage Rates Save Today.

Can I Deduct The Mortgage Interest On A Home I Own In Which A Family Member Lives

Deduct Mortgage Interest On Second Home

Mortgage Interest Deduction How It Calculate Tax Savings

220 5th Ave Seaside Heights Nj 08751 Trulia

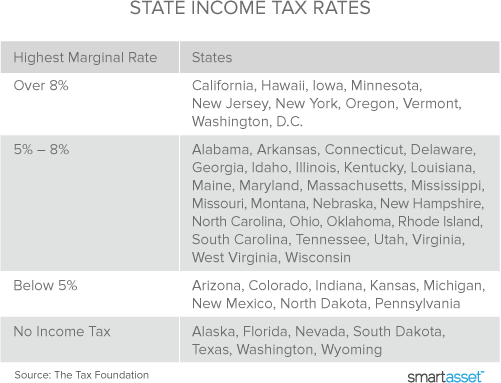

Mortgage Interest Tax Deduction Smartasset Com

Second Homes And The Mortgage Interest Deduction Brighton Jones

Sbdpwhole

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Can You Deduct Mortgage Interest On A Second Home Moneytips

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

2998 State Route 307 Austinburg Oh 44010 Mls 4422658 Zillow

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

What Is The Sum Of 4 44 444 4444 Quora

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Second Mortgage Tax Benefits Complete Guide 2023

How A Second Home Affects Taxes Nationwide